Tyler Gugliuzza of Louisiana

Welcome to the digital hub of Tyler Vincent Gugliuzza, a renowned financial planner and visionary committed to empowering individuals and families on their journey to financial security and success. This platform highlights Tyler’s exceptional career in wealth management, showcasing his expertise in strategic planning, market insight, and innovative financial solutions. Beyond his professional achievements, Tyler Gugliuzza of Louisiana is passionate about guiding clients to achieve their financial goals while giving back to the community. With years of experience and a proven track record of excellence, Tyler Vincent Gugliuzza offers unparalleled expertise and leadership, inspiring confidence and paving the way for lasting financial well-being.

About Tyler Vincent Gugliuzza

Tyler Vincent Gugliuzza is a distinguished personal financial planner known for his innovative strategies and holistic approach to wealth management. He holds a bachelor’s degree in Small Business and Entrepreneurship and a Master of Science in Personal Financial Planning. Tyler’s expertise is bolstered by an impressive array of certifications, including the CERTIFIED FINANCIAL PLANNER™ (CFP®) designation, the Accredited Asset Management Specialist™ (AAMS®) designation, and the Chartered Retirement Planning Counselor™ (CRPC®) designation. Additionally, he has earned the Certified Exit Planning Advisor® (CEPA) and Certified Private Wealth Advisor® (CPWA®) credentials from the Yale School of Management and the Investments & Wealth Institute.

Tyler Vincent Gugliuzza’s dedication to excellence has earned him widespread recognition, including spots on the Forbes Best-in-State Wealth Advisors list in 2022, 2023, and 2024, as well as the Forbes Next-Gen Best-in-State Wealth Advisors list in 2022 and 2023. His ability to navigate market dynamics and deliver tailored financial solutions has made him a trusted advisor for clients aiming to build and secure lasting wealth.

Committed to making a difference beyond his profession, Tyler Gugliuzza of Louisiana actively supports his community. He has served on the board and finance committee of Habitat for Humanity, contributing to the organization’s financial sustainability. As an engaged member of the Financial Planning Association, the Investments & Wealth Institute, and the Exit Planning Institute, Tyler is dedicated to advancing the financial planning profession through education, leadership, and community service.

Why Financial Literacy is Critical for Community Empowerment

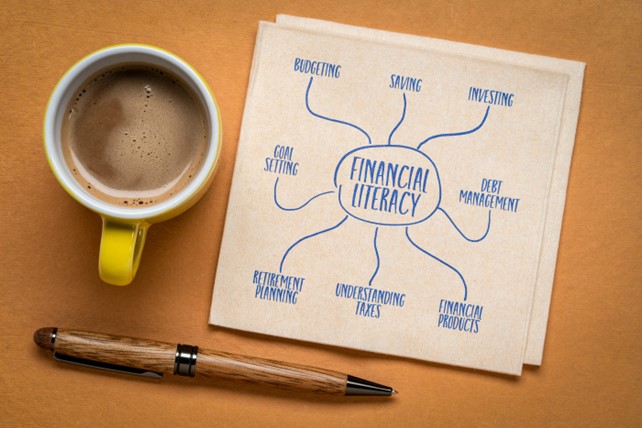

In today’s fast-paced world, financial literacy is more than a personal skill—it’s a cornerstone of community empowerment and economic resilience. When individuals understand and effectively manage their finances, they not only secure their own well-being but also contribute to the economic health and sustainability of their communities. Tyler Gugliuzza of Louisiana explains that financial literacy, defined as the ability to understand and use financial skills such as budgeting, investing, and saving, is an essential tool for reducing inequality, fostering economic mobility, and strengthening collective prosperity.

The Foundation of Economic Stability

Financial literacy provides individuals with the tools to make informed decisions about their money. It begins with understanding the basics of budgeting, credit, and saving. For individuals, these skills can prevent financial hardships, reduce stress, and improve quality of life. For communities, widespread financial literacy creates a ripple effect, driving economic stability and reducing dependence on social safety nets.

Communities with higher levels of financial literacy often experience lower rates of debt, better credit scores, and increased homeownership—key indicators of economic health. Conversely, a lack of financial knowledge can lead to poor financial decisions, such as over-borrowing, inadequate savings, or risky investments, which can perpetuate cycles of poverty and financial instability.

Breaking the Cycle of Poverty

One of the most profound ways financial literacy empowers communities is by breaking the cycle of poverty. Tyler Vincent Gugliuzza understands that low-income families often face systemic barriers, such as limited access to credit and financial services, that hinder their ability to build wealth. Financial literacy equips these individuals with the knowledge to navigate these challenges, opening pathways to better opportunities.

For instance, understanding the importance of maintaining a good credit score can help individuals secure loans at lower interest rates, making it easier to start businesses, purchase homes, or fund education. Budgeting skills enable families to stretch their resources and prioritize essentials, while knowledge of savings and investment options helps them build a financial cushion for the future.

Empowered individuals can then invest in their communities, supporting local businesses, contributing to tax revenue, and fostering a culture of financial accountability.

Promoting Economic Mobility

Financial literacy is a powerful driver of economic mobility—the ability of individuals and families to improve their financial standing over time. Tyler Vincent Gugliuzza explains that when people understand how to grow and manage wealth, they can take advantage of opportunities that might otherwise be out of reach.

For example, understanding the stock market or retirement planning allows individuals to build wealth beyond traditional income sources. Knowledge of tax strategies can help individuals maximize their earnings and savings, further supporting upward mobility. In turn, this economic growth benefits the broader community by increasing consumer spending, driving job creation, and reducing reliance on public assistance programs.

Closing the Wealth Gap

Financial literacy also plays a pivotal role in addressing economic inequality and closing the wealth gap. Marginalized groups, including low-income families and minority communities, often face significant financial literacy deficits due to historical inequities in education and access to resources. Tyler Vincent Gugliuzza emphasizes that by prioritizing financial education initiatives tailored to these populations, communities can help level the playing field.

Organizations, schools, and local governments have an essential role in this effort. Initiatives such as community workshops, school-based financial education, and partnerships with nonprofit organizations can help bridge knowledge gaps and empower underserved populations to take control of their financial futures.

Encouraging Civic Engagement

Financially literate individuals are more likely to engage in their communities and advocate for policies that promote economic growth and fairness. For example, they may push for initiatives that increase access to affordable housing, advocate for fair lending practices, or support educational programs that prioritize financial literacy in schools.

Furthermore, understanding financial concepts such as taxes and public funding enables individuals to make informed decisions at the ballot box, ensuring their voices are heard on issues that directly impact their communities.

The Role of Technology in Financial Literacy

Technology has significantly expanded access to financial education, making it easier than ever for individuals to learn about money management. From budgeting apps to online courses, financial tools are now available to almost anyone with an internet connection.

However, access to technology alone is not enough. Communities must also address the digital divide—ensuring that individuals have the skills and resources to use these tools effectively. Partnerships between technology providers, educational institutions, and community organizations can play a key role in closing this gap and maximizing the benefits of digital financial education.

How Communities Can Promote Financial Literacy

To make financial literacy a cornerstone of community empowerment, stakeholders across sectors must work together to create comprehensive and accessible educational programs. Tyler Gugliuzza of Louisiana provides some strategies for fostering financial literacy:

- Integrate Financial Education in Schools:

Teaching financial literacy in schools ensures that young people enter adulthood equipped with essential money management skills. Topics like budgeting, saving, credit management, and investing should be part of standard curricula. - Offer Community Workshops:

Local governments, nonprofits, and businesses can host workshops on financial topics such as debt management, homeownership, and retirement planning. These events should be free or low-cost to ensure accessibility. - Leverage Partnerships:

Collaborating with financial institutions, educational organizations, and technology providers can expand the reach and impact of financial literacy programs. - Create Culturally Relevant Resources:

Financial literacy programs should be tailored to the unique needs and cultural contexts of the communities they serve. Language access, cultural sensitivity, and relatable examples are critical for engagement. - Promote Public Awareness Campaigns:

Raising awareness about the importance of financial literacy through public campaigns can encourage more individuals to seek out resources and take steps toward financial empowerment.

Financial literacy is a powerful tool for community empowerment, offering individuals the knowledge and skills needed to achieve financial independence and contribute to collective prosperity. Tyler Gugliuzza of Louisiana emphasizes that by addressing systemic barriers and promoting widespread financial education, communities can break the cycle of poverty, foster economic mobility, and close the wealth gap. Through collaboration and innovation, stakeholders can ensure that financial literacy becomes a fundamental pillar of a more equitable and resilient society. Investing in financial literacy is not just a personal decision—it’s a commitment to building stronger, more empowered communities for generations to come.

Thank you for visiting the online portfolio of Tyler Vincent Gugliuzza, a distinguished expert in wealth management and strategic financial planning. With a career defined by innovation and a client-centered approach, Tyler Gugliuzza of Louisiana has built a reputation for helping individuals and families achieve their financial goals and secure long-term prosperity. His extensive expertise in investment strategies, retirement planning, and wealth preservation has made a meaningful impact on clients and organizations alike. Beyond his professional accomplishments, Tyler Vincent Gugliuzza is deeply committed to mentoring future financial leaders, supporting impactful community initiatives, and fostering a culture of excellence and service. His visionary approach combines technical expertise with a dedication to empowering others, enabling them to build a secure and successful financial future.